Commercial Psychology and Correlation on Market: Case Dogecoin (Dog)

The world of cryptocurrencies is becoming more complex, and an increasing number of players compete for dominance on the market. Among the numerous available CRIPTO currency, a pattern of examples of how business psychology can affect market performance: Dogecoin (eve) can affect. In this article, we will examine the fascinating relationship between business psychology and the correlation of the market in the context of Dogecoin.

What is business psychology?

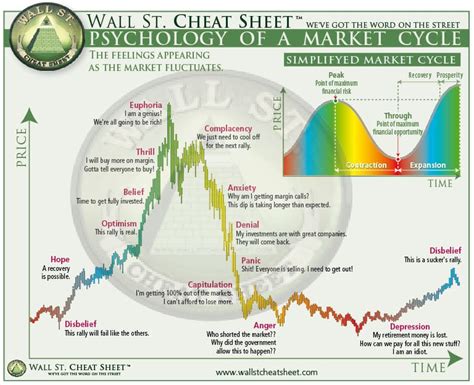

Commercial psychology refers to mental conditions and behavior that affect the process of making the individual decision during trading. These psychological factors can include emotions such as greed, fear, excitement and peace, as well as cognitive prejudices such as bias of confirmation, anchoring and aversion of loss. When merchants are aware of their own emotional state and bias, they can make more informed decisions about their business.

Case Dogecoin

In 2013, a group of enthusiastic enthusiasts was presented as a parody of Bitcoin Cryptocurrency Dogecoin (Doga). The initial coat of arms around Doga supported its innovative approach to the creation of currencies, low transaction fees compared to traditional payment systems and friendship and generosity of the community.

However, as the event increased popularity, her volatility did. In May 2014, the event reached a historic maximum of 0.87 USD before falling to just $ 0.01, deleting the considerable parts of the investors’ wealth. This dramatic swing price has launched a hot discussion on the role of psychology in trading.

Market Correlation: Example Dogecoin

The connection of the market refers to the tendency of different assets to move together. When he experienced his volatility during the rise, he often coincided with other cryptums such as Ethereum (ETH) and Litecoin (LTC). This synchronization is often referred to as “pumps and chousles”, where traders buy in anticipation of the increase in property prices just to sell at the top.

Investors who did not know about this correlation could react overly to the reaches of the reach price, which led to losses. On the contrary, those who have recognized the potential of market correlation and changed their strategies were able to avoid significant losses accordingly.

Factors of commercial psychology that contribute to market correlation

Several factors of commercial psychology contribute to the phenomenon of market correlation:

۱

- The anchor effect : the starting setting of the price price (eg $ 0.87) influenced the following stores as the traders tried to “recover” at its original price or maintain a perceived dog value.

۳ This fear can lead to exaggeration and sales during the market fall.

Conclusion

The Dogecoin case emphasizes that psychology trading can affect cryptocurrency market. By understanding psychological factors that affect trade decisions, traders can develop effective losses to alleviate losses and select informed investments.

Although it recognizes potential traps on trading psychology, it is necessary to recognize the importance of self -esteem techniques and risk management. Learning from the experiences of other traders who have faced similar challenges can improve our approaches and improve our overall business performance.

Recommendations

To avoid traps on market correlation:

۱.

- Diversify your portfolio

: distribute investments in different assets to reduce reliance on individual markets.