Creating a diverse Portfolio with Ethereum (ETH) and Non-Fungible Tokens (NFTS)

In today’s rapidly evolving digital landscape, cryptocurrency has emerged as a significant player in the market. Among its many applications, ethereum (ETH) and non-fungible tokens (NFTS) have gained popularity for their innovative use cases and potential for long-term growth. A well-diversified portfolio can help you navigate the crypto market effectively. In this article, we will explore how to create a diverse portfolio with ETH and NFTS.

What is Ethereum?

Ethereum (ETH) is an open-source, decentralized platform that enables smart contracts and decentralized applications (DApps). It was launched in 2015 by Vitalik Buterin and has since become one of the largest and most widely-used blockchain platforms. Ethereum’s primary function is to facility peer-to-peer transactions without the need for intermediaries.

What are non-fungible tokens (NFTS)?

Non-fungible tokens (NFTS) are unique digital assets that represent ownership and provenance of a particular item or event. They can be anything from art, music, or collectibles to in-game items or even virtual real estate. NFTS have gained significant attention in recent years due to their potential for high liquidity and scarcity.

benefits of using ETH and NFTS

Using Ethereum (ETH) and NFTS as part of a diverse portfolio can bring severe benefits:

- DIVERIFICATION : By incorporating ETH and NFTS, you can spread across different asset classes and reduce exposure to any one particular market.

- Potential for Growth : Both ETH and NFTS have the potential for high returns on investment, making them an attractive addition to a diverse portfolio.

- Unique Investments : NFTS Offer Unique Ownership and Provence, which can provide a competitive advantage in the market.

Creating a diverse Portfolio

To create a diverse portfolio with eth and nfts, consider the following steps:

- Understand your Risk Tolerance : Before investing in any asset, it’s essential to understand your risk tolerance level. If you’re new to cryptocurrency investments, it may be wise to start with more established assets like ETH.

- diversify across asset classes : Spread your Portfolio Across Different Asset Classes, Including:

* Stocks and Bonds

* Commodities (E.G., Gold or Oil)

* Cryptocurrencies (including ETH, Bitcoin, and Others)

* Alternative Investments (E.G., Real Estate or Private Equity)

- Allocate A Portion to ETH : Allocate 5-10% of Your Portfolio to Ethereum (ETH). This will allow you to take advantage of its potential for high returns while minimizing risk.

- diversify your NFT Portfolio : Allocate 5-10% of your portfolio to non-fungible tokens (NFTS) specifically designed on Ethereum (E.G., ERC-721 or ERC-1155). You can also consider investing in other nft platforms, such as opensea or ribble.

- Consider investing in other assets : Considering allocating a portion of your portfolio to other assets that complement eth and NFTS, such as:

* Stocks

* Real Estate Investment Trusts (Reits)

* Index Funds or ETFS

Additional tips

- educate yourself

: continuously educated yourself on the latest trends and developments in ethereum (ETH) and non-fungible tokens (NFTS).

- Stay up-to-date with Market News : Follow Reputable Sources to Stay Informed About Market News, Regulatory Changes, and Potential Risks.

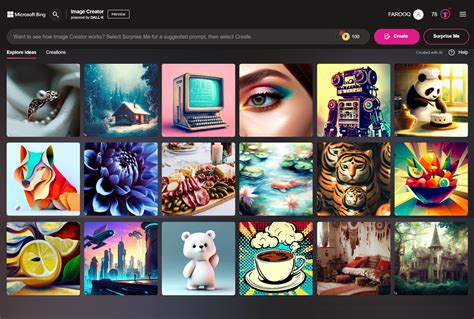

- Use Trading Platforms : Use Reliable Trading Platforms to Buy and Sell Cryptocurrencies, including ETH and NFTS.

- Consider Risk Management Strategies : Implement Risk Management Strategies, Such as Stop-Loss Orders or Portfolio Rebalancing, To Manage Your Portfolio’s Exposure to Market Fluctuations.